Last Updated on August 7, 2022 by The MediFi Guy

Capital Gains Tax has been mentioned in several previous articles, such as The Types of Investment Accounts, What are Unit Trusts and Exchange Traded Funds? and What are Retirement Annuities and Tax-Free Savings Accounts? but we have yet to cover what exactly the tax entails. In this article, we’ll cover everything you need to know about capital gains tax, how its calculated, and how it relates to investments made in a discretionary investment account. We’ll also briefly touch on Interest Income Tax and Dividends Withholding Tax.

What is Capital Gains Tax?

Capital Gains Tax is a tax on the profit made from the disposal of an asset. “Disposal” refers to the act of selling, donating, or destroying an asset. For our purposes, we’ll stick to thinking of disposal as being synonymous with selling an asset, since that’s the scenario applicable to the average person most of the time.

For illustration purposes we’ll focus on how capital gains tax relates to the sale of shares held in a discretionary investment account, notwithstanding the fact that capital gains tax applies to any type of asset class, including securities like bonds and property.

Remember that tax-advantaged investment accounts such as Retirement Annuities and Tax-Free Savings Accounts are exempt from Capital Gains Tax.

What are Capital Gains & Capital Losses?

A capital gain or loss is calculated by subtracting the base cost of the shares from the proceeds of the sale. The base cost is the price at which you bought the shares, and the proceeds refers to the money received from selling the shares.

If you’re selling the shares for a higher price than that which you bought them for, the capital gain is the amount by which the proceeds exceed the base cost.

For example, let’s say you bought shares for R100 and are now selling them for R200:

R200 (proceeds) – R100 (base cost) = R100 (capital gain)

If you’re selling the shares for a lower price than that which you bought them for, the capital loss is the amount by which the base cost exceeds the proceeds.

For example, let’s say you bought shares for R500 and are now selling them for R300:

R500 (base cost) – R300 (proceeds) = R200 (capital loss)

Understanding the Difference between Revenue and Capital

Before we get onto how capital gains tax is calculated, we first need to understand the concepts of revenue and capital.

When you sell shares, the first thing that needs to be determined is whether the proceeds you are getting from the sale are revenue in nature or capital in nature. The reason is that the nature of the proceeds determines how they will be taxed.

Revenue Proceeds

Revenue proceeds are the proceeds from the sale of shares that are held as “trading stock“. Trading stock refers to shares that were bought and disposed of within three years of their purchase.

You can think of it as shares that were bought with the intent of selling and making a quick profit.

Any profit made on the sale of this trading stock is classified as revenue in nature by SARS. Revenue is considered to be a form of normal income that forms part of your taxable income. It is therefore subject to Income Tax at your marginal tax rate in the exact same way that your salary is subject to income tax.

This marginal rate ranges from 18% to 45% depending on your tax bracket. Revenue is not subject to capital gains tax.

Capital Proceeds

Capital proceeds are the proceeds from the sale of shares that have been held for three or more years before disposal. Any profit made on these shares is classified as capital in nature by SARS.

Capital proceeds are subject to Capital Gains Tax.

How is Capital Gains Tax Calculated?

Capital Gains Tax is calculated by first subtracting the base cost of the shares from the proceeds of the sale to arrive at the capital gain.

This is followed by subtracting the annual exclusion amount of R40 000 (for individuals) from the capital gain, ie the capital gain is reduced by R40 000.

You then apply the capital gains tax inclusion rate of 40% to this figure by multiplying the figure by 40%, to arrive at an amount that you add to your taxable income for the year.

Your taxable income is then taxed at your marginal tax rate according to your tax bracket.

The steps of the calculation can be summarised as:

- Proceeds – Base Cost = Capital Gain.

- Capital Gain – R40 000 annual exclusion amount = [Figure]

- [Figure] x 40% inclusion rate = Amount added to Taxable Income

Let’s use three scenarios to illustrate the calculation. Scenario A is an example of how you normally pay income tax. Scenario B illustrates how you pay revenue tax. Scenario C illustrates how you pay capital gains tax.

Scenario A – Normal Income Tax

Let’s assume you’re a 24-year-old first-year Medical Intern earning a salary of R650 000 per annum, and that this is your only income source. Let’s also assume that you have no other applicable tax deductions such as medical aid or retirement annuity etc.

As such, your taxable income is R650 000. The way this would be taxed is as follows:

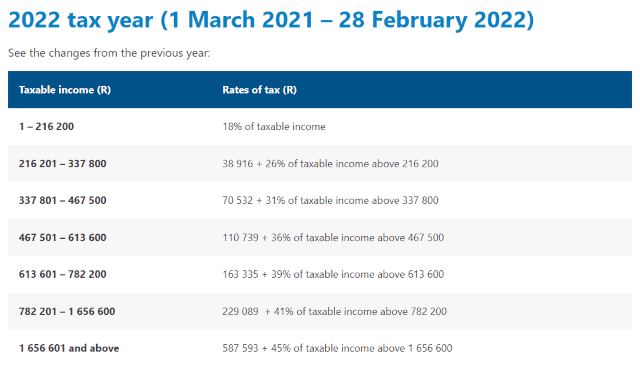

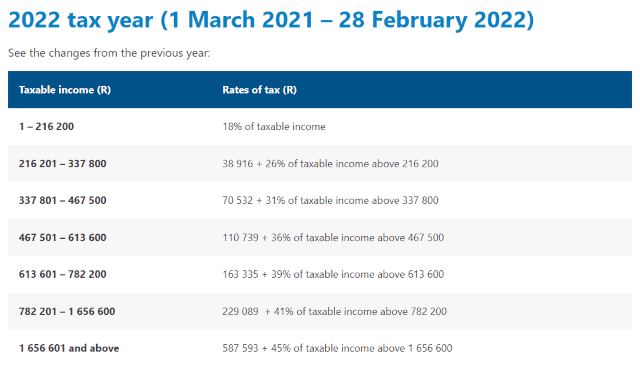

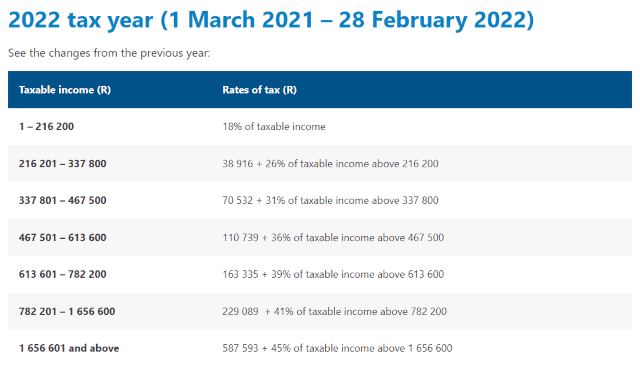

Taxable income = R650 000. This amount is applied to the SARS individual income tax table.

According to the SARS individual income tax table, your tax payable is R163 335 + 39% of taxable income above R613 600.

Therefore R163 335 + [39% x (R650 000 – R613 600)] = R177 531

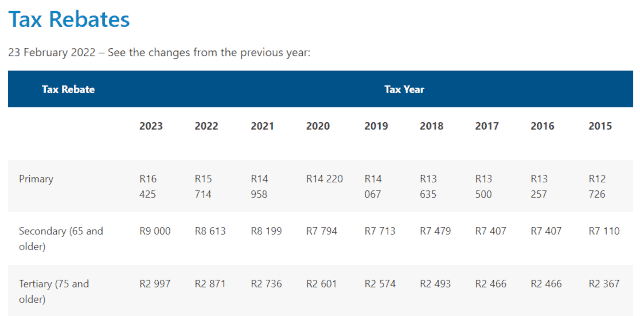

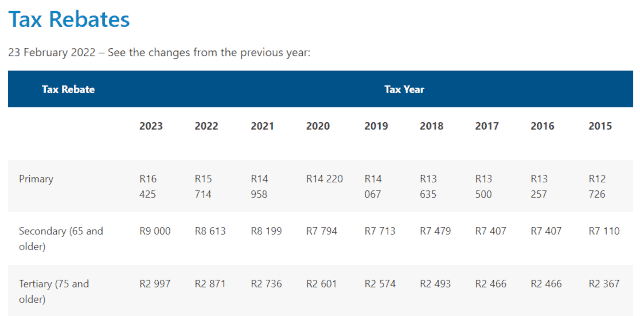

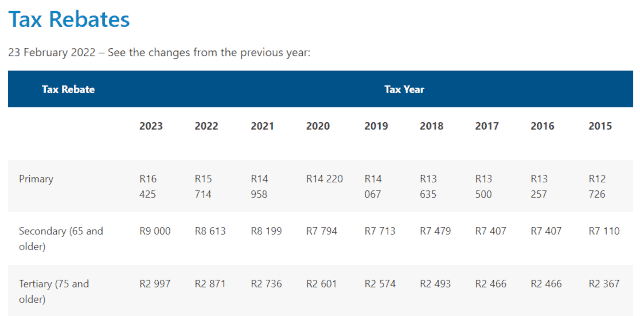

You then subtract the Primary Rebate from this amount according to the Tax Rebate Table

As a 24-year-old, the Primary Rebate applicable is R16 425

R177 531 – R16 425 = R161 106 tax payable

Therefore in total you will pay an income tax of R161 106.

If you compare this tax to your initial taxable income amount of R650 000, you have paid an effective tax rate of 24.79%.

Scenario B – Selling Shares of a Revenue Nature

Let’s assume you’re a 24-year-old first-year Medical Intern earning a salary of R650 000 per annum and that you have no other applicable tax deductions such as medical aid or retirement annuity etc.

However, in this example let’s also assume that during the tax year in question you bought shares to the value of R100 000 and 6 months later sold them for R200 000, netting you a profit of R100 000.

The way tax is calculated in this scenario is as follows:

Gross income = R650 000

Proceeds of R200 000 – The base cost of R100 000 = R100 000 profit.

This profit of R100 000 is added to your gross income of R650 000 to give you a taxable income of R750 000

Taxable income = R750 000. This is applied to the SARS individual income tax table.

According to the SARS individual income tax table, your tax payable is R163 335 + 39% of taxable income above R613 600.

R163 335 + [39% x (R750 000 – R613 600)] = R216 531

You then subtract the Primary Rebate from this amount according to the Tax Rebate Table

As a 24-year-old, the Primary Rebate applicable is R16 425

R216 531 – R16 425 = R200 106 tax payable

Therefore you will pay an income tax of R200 106.

If you compare this tax amount to the tax payable in Scenario A above, R200 106 – R161 106 = R39 000 additional tax that you pay due to the profit of R100 000 on the sale of the shares.

Scenario C – Selling Shares of a Capital Nature

Let’s assume you’re a 24-year-old first-year Medical Intern earning a salary of R650 000 per annum and that you have no other applicable tax deductions such as medical aid or retirement annuity etc.

However, in this final example let’s also assume that 5 years ago you bought shares to the value of R100 000, and sold them for R200 000 in the current tax year, giving you a profit of R100 000.

The way tax is calculated in this scenario is as follows:

Gross income = R650 000

Proceeds of R200 000 – The base cost of R100 000 = R100 000 profit.

Since this sale was of shares held for a period longer than 3 years, the profit is considered to be a capital gain. Therefore capital gains tax calculations are applied to the profit amount:

Capital Gain on Sale = R100 000

Capital gain – annual exclusion = R100 000 – R40 000 = R60 000

R60 000 x 40% inclusion rate = R24 000 net capital gain inclusion

This capital gain inclusion of R24 000 is added to your gross income of R650 000 to give you a taxable income of R674 000

Taxable income = R674 000. This is applied to the SARS individual income tax table.

According to the SARS individual income tax table, your tax payable is R163 335 + 39% of taxable income above R613 600.

R163 335 + [39% x (R674 000 – R613 600)] = R186 891

You then subtract the Primary Rebate from this amount according to the Tax Rebate Table

As a 24-year-old, the Primary Rebate applicable is R16 425

R186 891 – R16 425 = R170 466 tax payable

Therefore you will pay an income tax of R170 466.

If you compare this tax amount to the tax payable in Scenario A above, R170 466 – R161 106 = R9 360 additional tax that was paid due to the profit of R100 000 on the sale of the shares.

As you can see, this additional capital gains tax of R9 360 is significantly less than the R39 000 that was paid as revenue tax in Scenario B, even though the sale of shares resulted in the exact same profit of R100 000 in both scenarios. The only difference is that in Scenario B the profit is revenue in nature whereas in Scenario C it is capital in nature.

Why is Capital Gains Tax lower than Revenue Tax?

It basically comes down to the math.

In Scenario B above the R100 000 profit was taxed as revenue. Therefore the marginal income tax rate according to the tax bracket is what was applied to it.

In the example the applicable marginal tax rate was 39%, therefore 39% x R100 000 gave us a tax of R39 000 on the profit.

In contrast to this, in Scenario C the R100 000 profit was taxed as a capital gain. Therefore the capital gain individual exclusion amount of R40 000 is first subtracted followed by the inclusion rate of 40% being applied before the amount can be taxed at the marginal income tax rate.

These 2 initial steps significantly reduce the effective tax that ends up being calculated on the profit. You can think of it as [your marginal tax rate x 40% x (profit – R40 000)].

Matter of fact, due to the way that capital gains tax is calculated, the most capital gains tax an individual can possibly pay is only 18%.

If you take the marginal tax rate of 45% for the highest tax bracket and calculate the capital gains tax such an individual would have to pay:

40% x 45% = 18%.

Therefore an 18% capital gains tax is the highest a member of the top tax bracket can end up paying.

So whereas tax of a revenue nature can vary from 18% to 45% depending on your tax bracket, the highest capital gains tax can go is only 18%.

This is why one tends to pay higher taxes for assets that are held in a discretionary account and are frequently traded for short term gain. It is due to the revenue taxes on the trades.

Assets that are held long-term (ie more than 3 years) in discretionary accounts are subject to a much lower capital gains tax upon disposal.

Dividends Tax

When dividends are given to shareholders, they are subject to a dividends tax, which is usually deducted from the dividend payment by a withholding agent. The withholding agent is either the company paying the dividend or a regulated intermediary. To quote SARS:

“Dividends received by individuals from South African companies are generally exempt from income tax, but dividends tax at a rate of 20% is withheld by the entities paying the dividends to the individuals”

In other words, if you’re holding shares that pay dividends, prior to the company paying out the dividend they first subtract 20% from it and pay that to SARS on your behalf as a dividends withholdings tax. You then receive the remaining 80% as your dividend payout.

The dividends tax is payable on or before the last day of the month following the month in which the dividend was paid.

Whilst the shareholder is the one liable for the tax once a dividend is paid out to them, it is the responsibility of the withholding agent to withhold the tax, pay it to SARS, and notify the shareholder of its payment.

Interest Income Tax

Interest earned from cash in the bank, medical savings accounts, bond investments, and certain unit trust holdings are subject to interest income tax.

The interest earned is exempt from taxes up to an amount of R23 800 per annum for individuals under the age of 65 and R34 500 per annum for individuals aged 65 and older. It is the amount of interest over and above this annual exemption which is subject to income tax at your marginal income tax rate.

In practical terms, this means that if you earn a total interest of R23 800 or less in a given tax year (as a 25-year-old) you do not pay any taxes. If you earn more than R23 800 in a given tax year, the interest is added to your taxable income, which is then taxed according to the marginal tax rate of your individual income tax bracket.

The individual is liable for the payment of this tax and must declare this interest when filing their tax return.

Legal Disclaimer: The information on this website including research, opinions or other content is not intended to and does not constitute financial, accounting, tax, legal, investment, consulting or other professional advice or services. The author of this blog does not act or purport to act in any way as a financial advisor or in a fiduciary capacity. Prior to making any decision or taking any action, which might affect your personal finances or business, you should take appropriate advice from a suitably qualified professional or financial adviser.